Market Performance Standards and the Customer Journey

This year we have adopted a customer lens to our reporting. Standards have been collated to reflect the following steps in the customer journey.

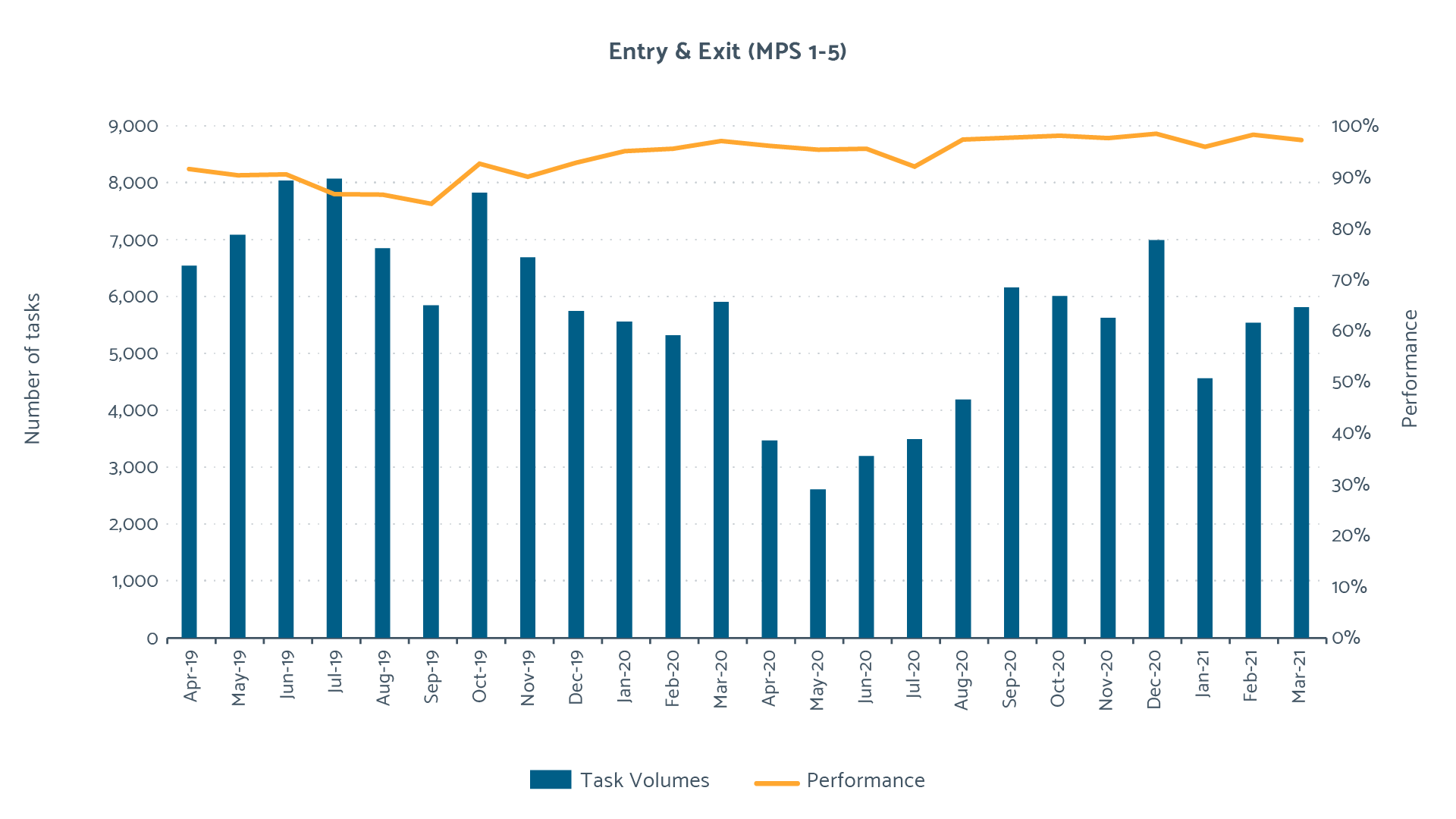

Market Entry (MPS 1-5)

These standards capture the provision of customer premises, meter and business data into CMOS. If data is omitted at this early stage then issues can incur at a later date. For example, premises marked as vacant may not be assigned enough resource to subsequently locate and redefine them; meter locations may be inaccurate, or their data may be incorrect, leading to skipped or rejected reads; customer billing addresses may be incorrect, leading to a poor billing experience.

Market Entry Performance Observation

The pandemic has resulted in fewer new premises being added to in the NHH water market. This is shown by the task volumes which immediately declined as we moved into the first lockdown and remained at a lower volume until the restrictions eased. The effects of the subsequent regional restrictions and second national lockdown delayed the recovery of these task volumes until February 2021 when the UK Government announce the roadmap for the easing of restrictions.

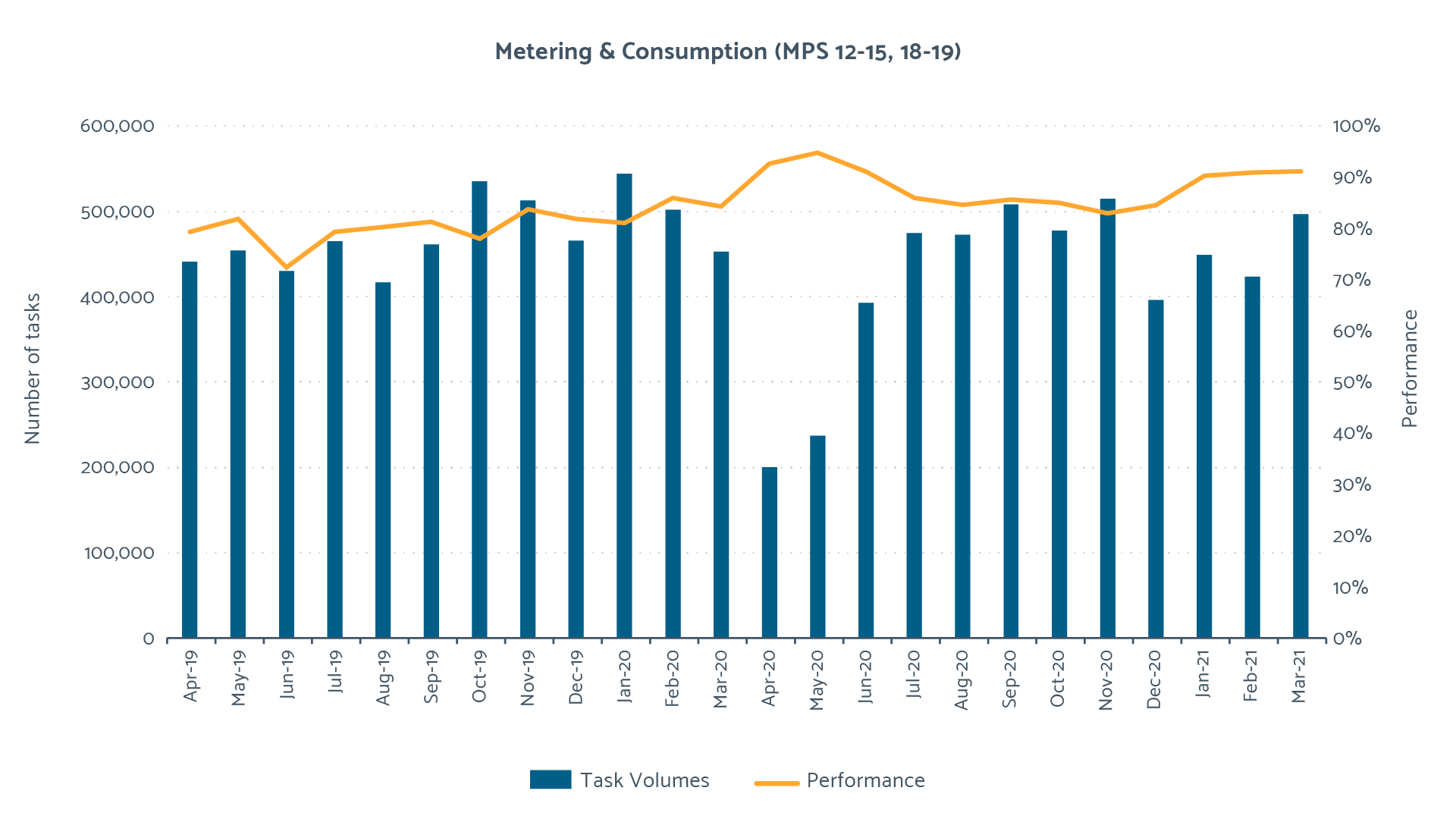

Metering and Consumption. (MPS 12-15, 18 and 19)

These standards capture the taking and submitting of market and non-market reads by retailers and wholesalers (and their accredited entities) to ensure that timely and accurate consumption data supports accurate settlement and customer billing.

Observation

Performance has remained high whilst task volumes have reduced.

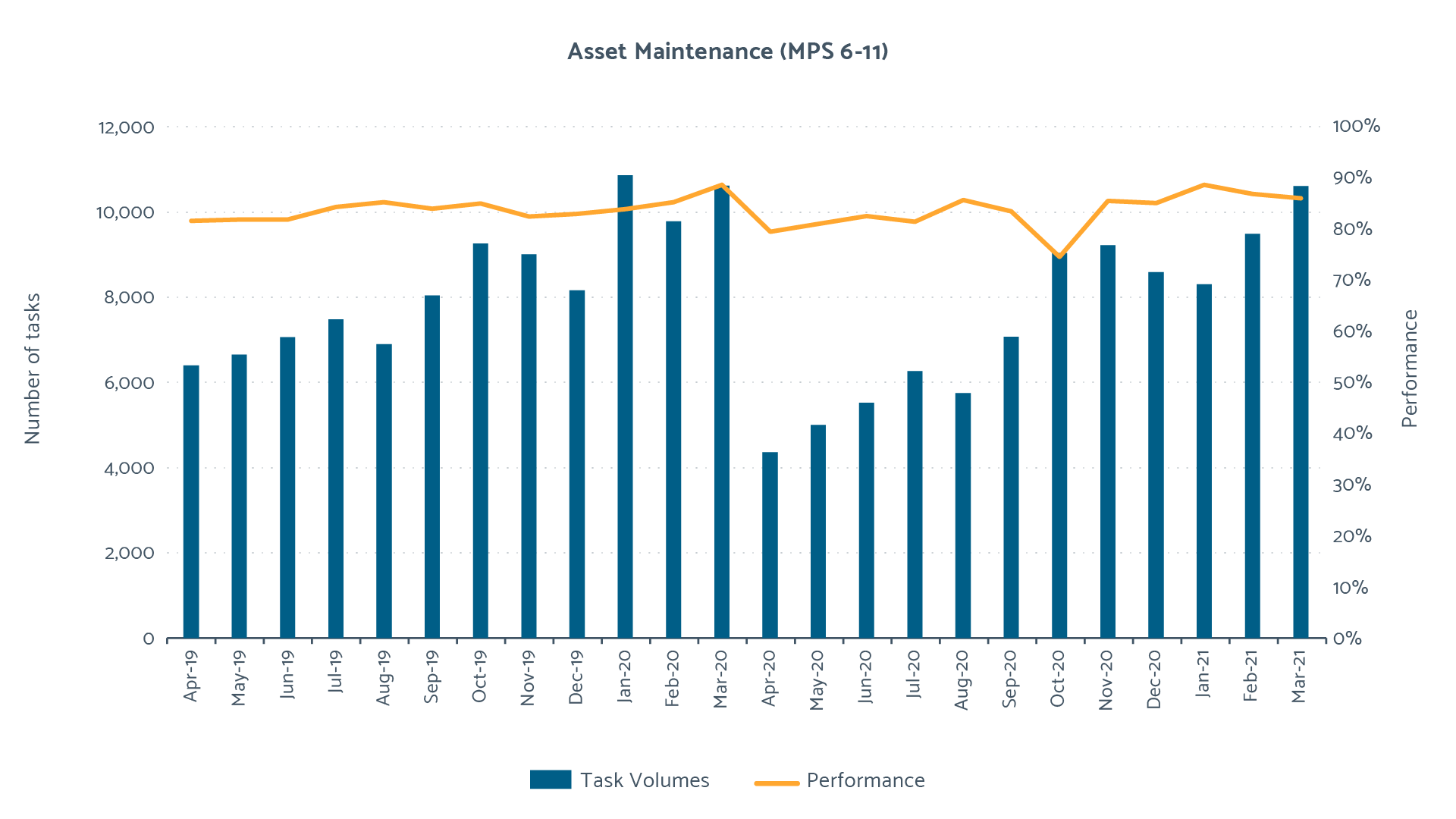

Asset Maintenance (MPS 6-11)

These standards capture the taking and submitting of initial and final reads as meter readings are exchanged and repaired in response to operational tasks.

Observation

Although performance remained high for these tasks, their volume suffered a significant decline during the first national lockdown as bilateral requests reduced or were deferred by the wholesalers because of site access restrictions.

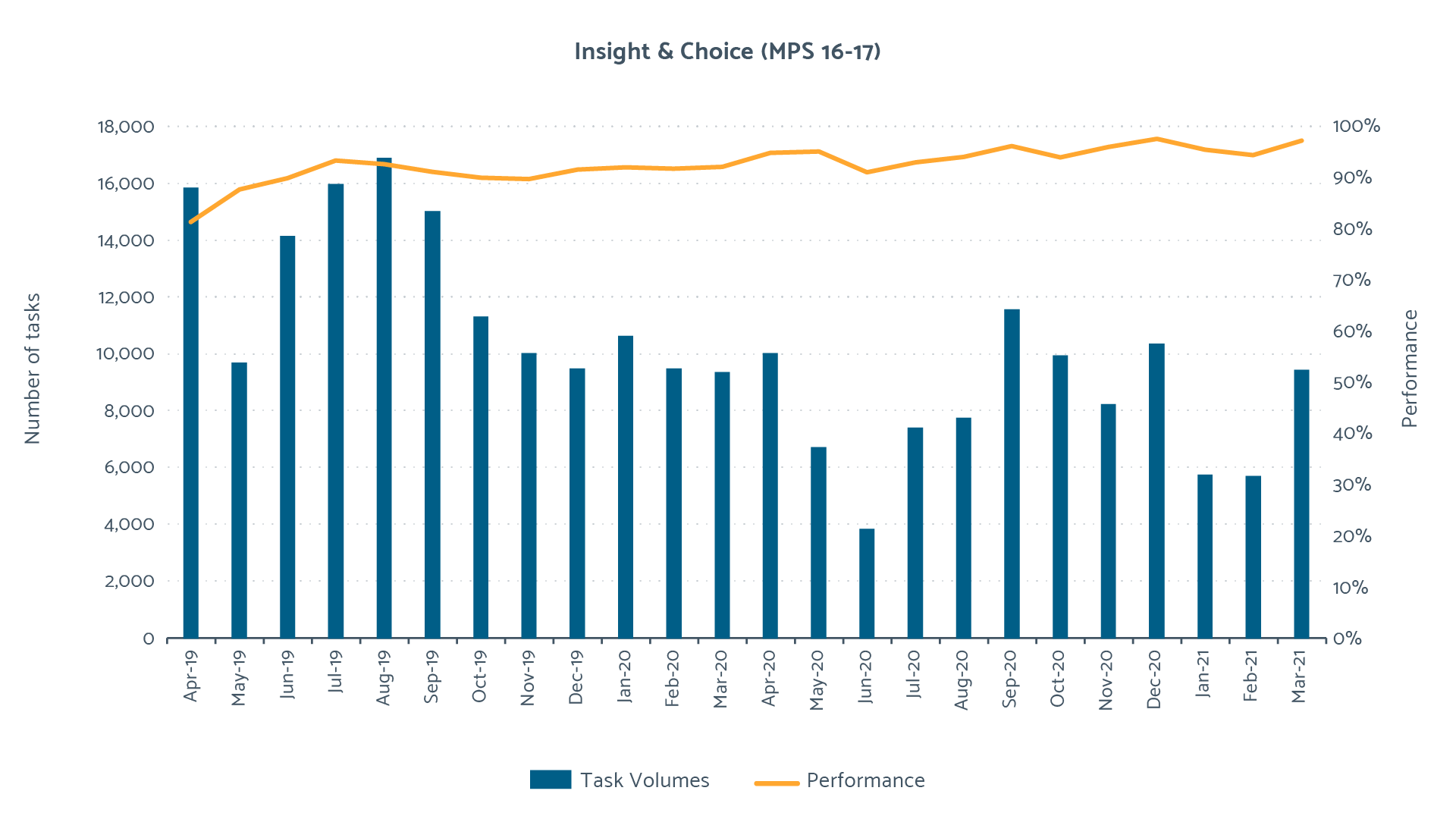

Customer Choice (MPS 16 and 17)

These standards capture the taking and submitting of reads as customers switch suppliers.

Observation

Switching declined during lockdown and over the last year has been lower than average. In August 2020, the lifting of lockdown restrictions resulted in a surge of requests bringing the volume close to the pre-lockdown levels. This figure subsequently fell in the following months as first regional and then national lockdowns were imposed. Performance in these standards has remained above 90 per cent throughout the year.

MPS League Tables

These league tables have evolved this year to show performance within the retailer/wholesaler pairings. The full set of league tables can be found on the MOSL website.

Observation

It should be noted that some trading parties may have significantly higher volumes of meter reads than expected where the submission of Automatic Meter Readings (AMR) reads are prevalent. The peer comparison league tables which represent performance against the retailer/wholesaler pairings can also be found in the link above.

Rectification Plans

No new Initial Performance Rectification Plans (IPRPs) were requested during 2020/21 as IPRPs were suspended in line with the suspension of market charges. At the start of the financil year nine trading parties were on, or were concluding, existing IPRPs. Reviews of trading party performance against their IPRPs were suspended during 2020/21. MOSL will consider whether these IPRPs will be de-escalated or extended in Q1 2021/22.

The Market Performance Committee requested a Performance Rectification Plan (PRP) from Water Plus in March 2020 for under performance against MPS 16.

The PRP was successfully completed in August 2020 with Water Plus performance in MPS 16 rising from 65 per cent in March 2020 to 96 per cent in August 2020.