Customer Impact

As outlined in our 2021-24 Business Plan and Strategy, customers are central to our decision-making. This means we need to change how we address challenges to focus on better customer outcomes such as improved billing, with granular customer segmentation and consumption data.

The need for greater customer segmentation became clearer when non-essential businesses were instructed to close. The government guidelines issued Standard Industry Classification codes to determine the categories for essential and non-essential businesses. This meant we needed to understand the potential impacts on the market by leveraging CMOS capability to group customers according to industry standards. Accurate customer segmentation will enable us to better understand the immediate and future impacts of COVID-19 and other systemic challenges such as water shortages.

The imposed national lockdown meant many businesses, not defined as “essential”, closed their premises in a manner which did not meet the industry definition of vacant premises.

In response, Ofwat and MOSL introduced the temporary vacancy flag set out in change proposal (CPW091): ‘Temporary Changes to Vacancy’. The use of the COVID-19 temporary vacancy flag ensured settlement reflected that sites were closed, which facilitated appropriate customer billing. The terms set out in the change proposal provided retailers with the ability to mark premises as temporarily vacant where they were fully closed or where activities had reduced by 95 per cent. It was a means for identifying reduced consumption of 95 per cent or where there were significant challenges to obtaining accurate meter reads.

Using the occupancy status of vacant for premises which did not meet the industry definition had the potential to create inaccurate future reporting on occupancy. The permitted use of the temporary vacancy flag ceased at the end of July 2020 as lockdown restrictions were lifted and a two-month period of “unwinding” began. Flag removal was reported by MOSL. Ofwat, CCW and MOSL established the Covid Transition Review Group (CTRG) to assess the progress of the market as it transitioned out of temporary vacancy measures.

For subsequent national or regional lockdowns, the reduction in estimated consumption was captured by the reduction of Yearly Volume Estimates (YVES). YVEs are examined in further detail within the Market Consumption section of this report.

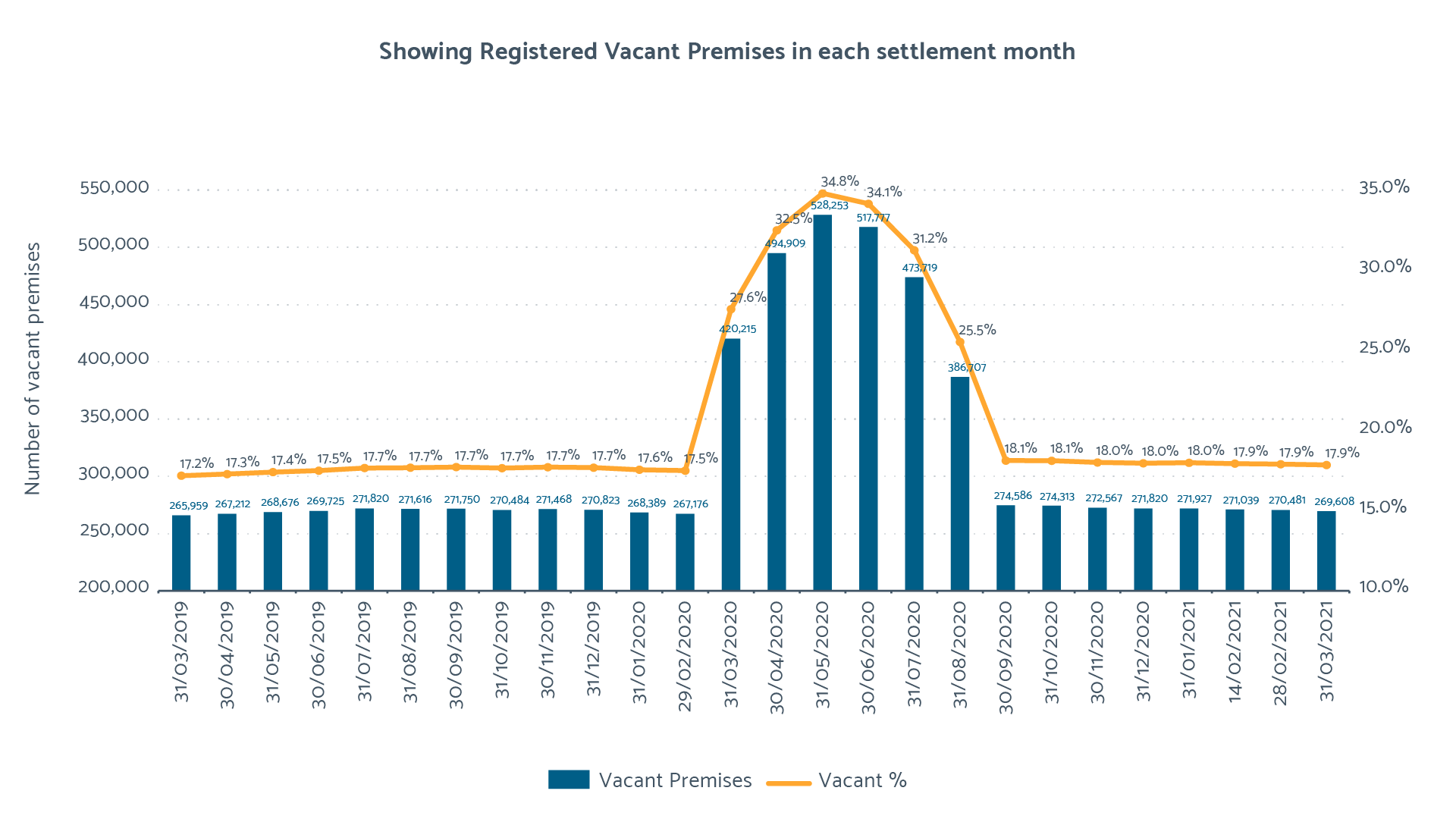

The application and subsequent removal of the temporary vacancy flag against approximately 250,000 premises can be seen in the 2019/20 Vacant Premises chart which represents the number of premises registered as vacant in each of the settlement months.